At a board meeting on Thursday, the Fulton County Board of Tax Assessors decided that Fulton County property tax owners who had a rate freeze in place and saw their assessment values increase will go back to their frozen levels.

The Fulton County Chief Appraiser says the board was not in compliance by unfreezing the rates.

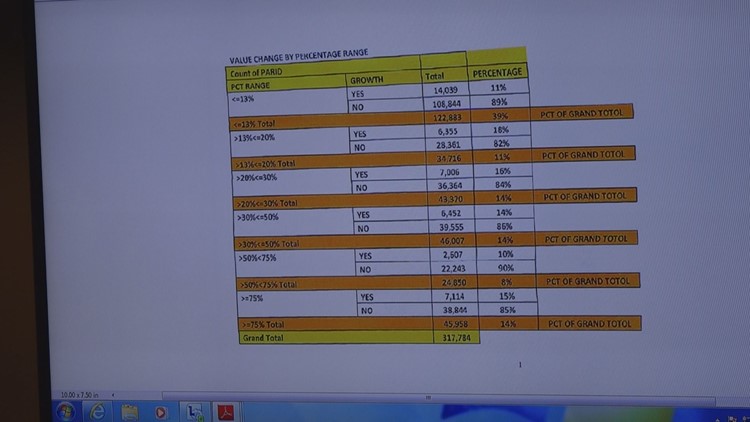

Properties that saw more than a 50 percent increase -- some 61,000 parcels -- were reviewed, and certain neighborhoods were flagged for correction, officials said. The cities of East Point, College Park and Milton were most heavily affected.

This means homeowners in those communities will see their property assessments go down.

After making those decisions, the board went into executive session to discuss further action, including calls to freeze property taxes or rescind controversial new assessments.

They later said they do not have the legal authority to rescind the tax notices. The only ramifications taxpayers have is to go through the appeals process.

In addition to the 61,000 parcels that had the greater-than-50 percent increase that they are already reveiwing, they are also reinstating freezes on 1,800 properties that previously had a freeze, but were unfrozen. They have also directed their attorney to look at gentrification issues in Atlanta's Old Fourth Ward neighborhood.

The Fulton County Board of Tax Assessors was set to decide on Thursday whether they would 'freeze' property assessments at 2016 rates, or allow higher assessments to move forward.

{"author_name":"Kaitlyn Ross 11Alive","author_url":"https://www.facebook.com/kaitlynrossjournalist/","provider_url":"https://www.facebook.com","provider_name":"Facebook","success":true,"height":281,"html":"&#lt;div id=\"fb-root\"&#gt;&#lt;/div&#gt;\n&#lt;script&#gt;(function(d, s, id) {\n var js, fjs = d.getElementsByTagName(s)[0];\n if (d.getElementById(id)) return;\n js = d.createElement(s); js.id = id;\n js.src = \"//connect.facebook.net/en_US/sdk.js#xfbml=1&version=v2.3\";\n fjs.parentNode.insertBefore(js, fjs);\n}(document, 'script', 'facebook-jssdk'));&#lt;/script&#gt;&#lt;div class=\"fb-video\" data-href=\"https://www.facebook.com/kaitlynrossjournalist/videos/1581167881913813/\"&#gt;&#lt;blockquote cite=\"https://www.facebook.com/kaitlynrossjournalist/videos/1581167881913813/\" class=\"fb-xfbml-parse-ignore\"&#gt;&#lt;a href=\"https://www.facebook.com/kaitlynrossjournalist/videos/1581167881913813/\"&#gt;&#lt;/a&#gt;&#lt;p&#gt;FULTON COUNTY TAX REVOLT - dozens of tax payers are asking The Fulton County Board of Assessors to roll back massive tax increases NOW!&#lt;/p&#gt;Posted by &#lt;a href=\"https://www.facebook.com/kaitlynrossjournalist/\"&#gt;Kaitlyn Ross 11Alive&#lt;/a&#gt; on Thursday, June 15, 2017&#lt;/blockquote&#gt;&#lt;/div&#gt;","type":"video","version":"1.0","url":"https://www.facebook.com/kaitlynrossjournalist/videos/1581167881913813/","width":500}

Last week, the Board decided to put off the vote until today. Their meeting was filled with emotional testimony and explosive moments but, ultimately, no action to provide relief for taxpayers. This comes after weeks of concerns about rising property assessments all over Fulton County.

“I’m feeling like the tax notices ought to be called eviction notices because that’s the reality of what is going to be going on with people of modest means that live in our communities,” said Barbara Antonopolis a longtime Grant Park resident.

Fulton County Board of Commissioner members John Eaves and Bob Ellis asked the board to consider a 30-day freeze of assessments, in order to reevaluate the issue. Ultimately, the Board of Assessors decided to postpone a vote until next Thursday.

11Alive News first broke the story of the property assessment increases in early May. 61,000 homes saw a 50% or more assessment increase. That adds up to thousands of more dollars in taxes each year. More than half the homes in Fulton County saw an assessment increase of 20% or more.

“We put the values where they are supposed to be,” said Dwight Robinson, chief appraiser for Fulton County.

Robinson said his office is simply bringing property assessments up to real-world values. He says his office will face fines from the Dept. of Revenue if his valuations of property are less than their actual value.

“Sooner or later if I don't do that… evaluate these properties… I will be asked why are you not assessing properties at their fair market value?” said Robinson. “I'm placed in the position of having to do just that.”

Residents say massive increases like this are forcing out longtime residents.

“We are facing the reality that we could be forced out of our homes in the communities that we live in and want to live in until we have to be carried out because we cannot continue to afford to pay one crease after another,” said Antonpolis.

The largest assessment increases have hit areas in North Fulton like Milton and Alpharetta, Chattahoochee Hills in South Fulton, and rapidly changing areas along the Beltline in Atlanta like the Old Fourth Ward.

“Give us some time to work with the state legislature,” pleaded Antonopolis. “I know the laws need to be changed, but that’s what’s driving this kind of a mess.”

The Board of Assessors ultimately voted to postpone until next Thursday the vote on freezing property assessments. Three of the five commissioners would have to vote in favor of a freeze for that to happen.

The deadline to file an appeal of your assessment is July 10. As of Thursday morning 1,939 people have filed paperwork to appeal their assessment.

The appraiser’s office has 180 days to resolve your appeal, or ask for another 180 day extension. While your appeal is being resolved, you must pay the temporary tax bill you have receive in order avoid any penalties and fees you may incur. Once the appeal is resolved, the Tax Commissioner's Office will recalculate your tax bill based on the final value.

Homeowners can also file for more than a dozen exemption to reduce tax bills. Exemptions are based on specific criteria and qualifications, and there are particular annual deadlines to meet in order to receive the annual exemptions. The filing for the 2017 Homestead Exemption has already passed, but the 2018 Homestead Exemption deadline is April 1, 2018.

Filing an appeal of your assessment and filing for a Homestead Exemption may be taken care of at the Fulton County Board of Tax Assessors' website.

Any questions homeowners have regarding property tax assessment appeals or homestead exemptions may be directed to the Fulton County Board of Tax Assessors at 404-612-6440.