Fulton County commissioners, citing a law dating back to 1880, unanimously voted to freeze property assessments at the 2016 rates on Wednesday. The vote effectively halts the six-week controversy swirling around Fulton County property assessments.

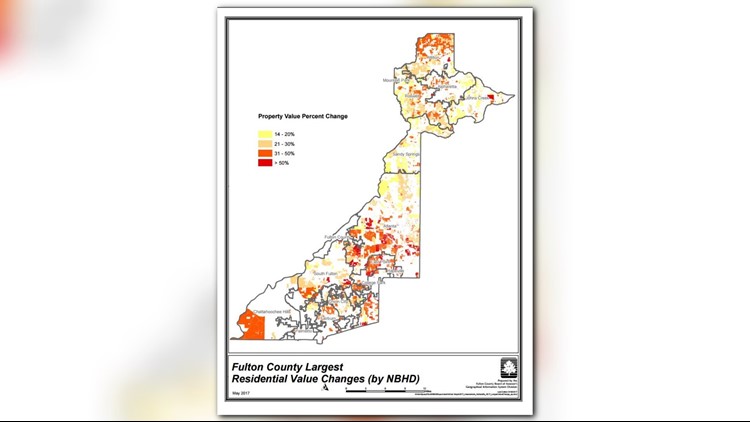

11Alive was the first media outlet to report the dramatic increases in early May. Assessments rose more than 20% for half of Fulton County homeowners, in some cases they rose 100-300%. In layman’s terms, that means many homeowners must pay thousands of dollars more in taxes this year.

“Our taxes increased by 300% and there’s no precedent for that in our neighborhood,” said Michael Faust, a Fulton County resident who spoke before the vote. “It’s going to prevent me from staying in that neighborhood that I’ve lived in for 17 years. And I love that neighborhood.”

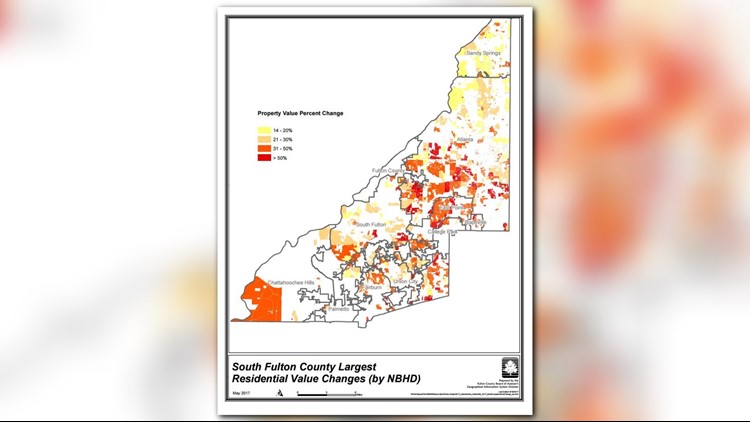

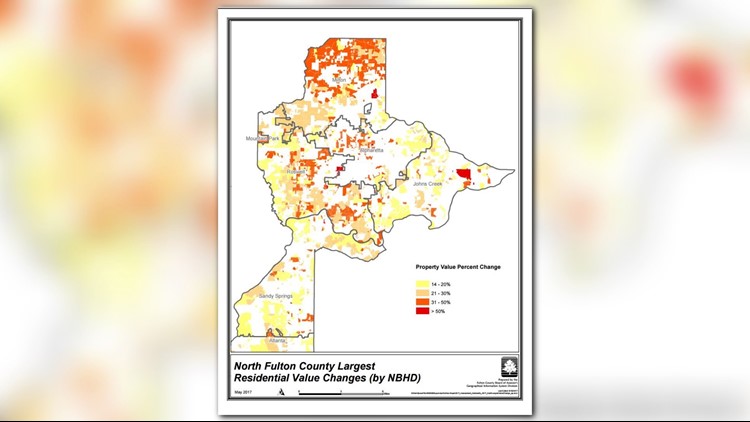

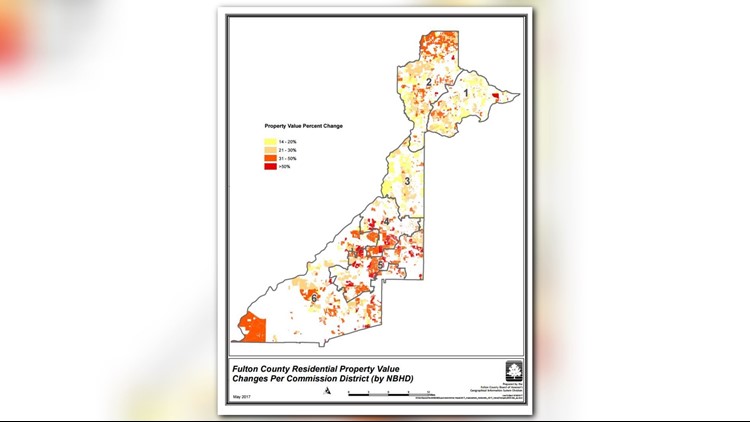

Fulton Tax Revolt: Property assessment maps

“These are people’s lives. Are people facing eviction? Will they lose their homes? Can they afford medical care now?” said Councilman Bob Ellis. “it’s temporary and a lot more work needs to be done.”

Residents and commissioners alike agreed that Wednesday's action is a temporary solution.

“We’ve found a law to put a stop temporarily to this increase and allow us time to find a solution permanently,” said Commissioner Liz Hausmann. “I pledge to work diligently with the legislature to come up with a simplified solution that is fair.”

Residents and officials say the next step will be to work with state legislators to change Georgia laws to cap property assessment increases each year or offer other permanent solutions.

”This is a temporary fix, not a permanent solution as to how we appraise and levy property taxes,” said Gary Cox, a Fulton County homeowner. “A freeze will not fix the problems for homeowners and seniors. Past inaction by this board has exacerbated this problem and we, the people, want it fixed.”

The assessment increases impacted the entire county from Milton in north Fulton to Chattahoochee Hills in the south. Certain pockets in the City of Atlanta, however, including the rapidly gentrifying Old Fourth Ward were among the hardest hit.

“There’s not enough development, crime prevention, or development in neighboring areas, said Faust, a Castleberry Hill resident. “That doesn’t support a 300% increase in taxes.”

Ellis and Council Chairman John Eaves were the first officials to ask the Fulton County Board of Tax Assessors to throw out this year’s tax digest and assessments, and freeze rates at 2016 levels. Responding to that request last week, the Board of Assessors said they did not have the power to freeze assessments, according to the county attorney. However, they are responsible for approving the original 2017 Tax Digest and assessment rates.

What you need to know

The Fulton County tax assessment notice you received in May or June is now null and void. You will receive a new assessment, which should be mailed to you around mid-August.

If you have already filed an appeal it is now null and void. You will have a chance to appeal the notice you receive in August, if you feel it is in error. You will have 45 days after you receive the new notice to file your appeal online.

Fulton County also offers more than a dozen exemptions or tax relief options. It is too late to apply for these for this tax year, but you can do so for the 2018 year.

The next step in this process, is for residents and elected officials to begin the long, arduous task of changing the laws surrounding property assessments.

“One of the things I like about this action is that it demonstrates that this government will listen,” said Commissioner Emma Darnell, who pledged to work with the state legislature to change the laws. “You don’t have to have a big name. You don’t have to be political. We will listen. That‘s the bottom line. And not only will we listen but we’ll do something about it.”