Normally reporters avoid becoming the focus of their own story. I love telling stories… just not my own.

But when I became a victim of identity theft, my boss asked me to document the experience. I envisioned some boring video of me making phone calls (and there was plenty of that) but honestly, I had no idea what I had agreed to.

There was outrage, irritation, anger, frustration, laughter and frankly, exhaustion. Looking back now, my emotions seem a bit melodramatic, but as it was happening, I felt completely overwhelmed.

I’m the kind of person who saves all of my receipts and cross checks them with my credit cards. I balance my checkbook to the penny every month. I thought I was already on top of this kind of thing. Gold star for me.

Turns out my gold star isn’t so shiny.

I first realized something was wrong when I started opening my mail. Someone had made a fraudulent purchase on my Express credit card. I hadn’t used the card in more than a year, plus the purchases were made at a store in San Diego. I hadn’t been out of Atlanta in months.

I called the company, reported the fraud and thought it was over. Then I logged into my Chase bank account to pay bills. The account balance was virtually zero.

I feverishly looked at the debits on the account and noticed four money orders purchased back to back. They were all cashed, in either my or my husband’s name, hours later draining nearly $5,000 from my account.

I called Chase and they immediately froze my account, with the warning it could take 10-30 days to complete the investigation.

That’s when I started to share my story on Facebook. Everyone seemed surprised Chase didn’t issue a provisional credit, so I asked the company about it. A spokesperson told me Chase will issue provisional credits, if the theft involves a debit or credit card, because there are systems in place to make it easier for financial institutions to recoup the money.

But when a check or money order is involved, they’re dealing with another bank, and that process is harder. So, they really want to make sure your claim is legit before giving the money back.

That’s when I realized, Chase wasn’t necessarily going to conduct an investigation to catch the thieves. They were going to investigate me… to determine if I was telling the truth.

I was told Chase would review handwriting to see if the signatures on my account and the money orders matched. They would look at my spending history and banking history to determine if the alleged fraudulent activity seemed out of character.

All I heard, was that there was no guarantee I would ever get my money back. And while waiting, I had to come up with another way to pay my bills.

Compounding the problem, both me and my husband used direct deposit. This all happened around payday, so before we could tell out companies what happened, our paychecks were deposited into a frozen account we couldn’t touch.

So now we’re out $5,000 and both of our most recent paychecks. The mortgage was due in three days.

I went to Cobb County police. They referred me to the sheriff’s office. They told me I had to come in person to make a report. I called in late for work and did so.

I contacted the credit bureaus to freeze my credit. I pulled credit reports to see who else may have given a line of credit to thieves.

In the days to come, I dreaded opening my mail. There were credit cards I didn’t request, ready to be activated. Thieves applied for them when making online and in-store purchases, so the damage was already done. There were letters telling me the loans I had applied for were being denied.

I eventually called and cancelled all of my existing credit cards but one, just to try to get ahead of the action. It lightened my wallet and gave me peace of mind.

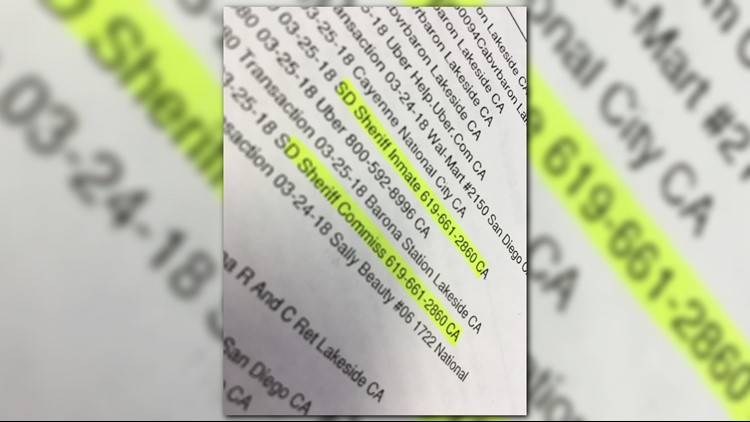

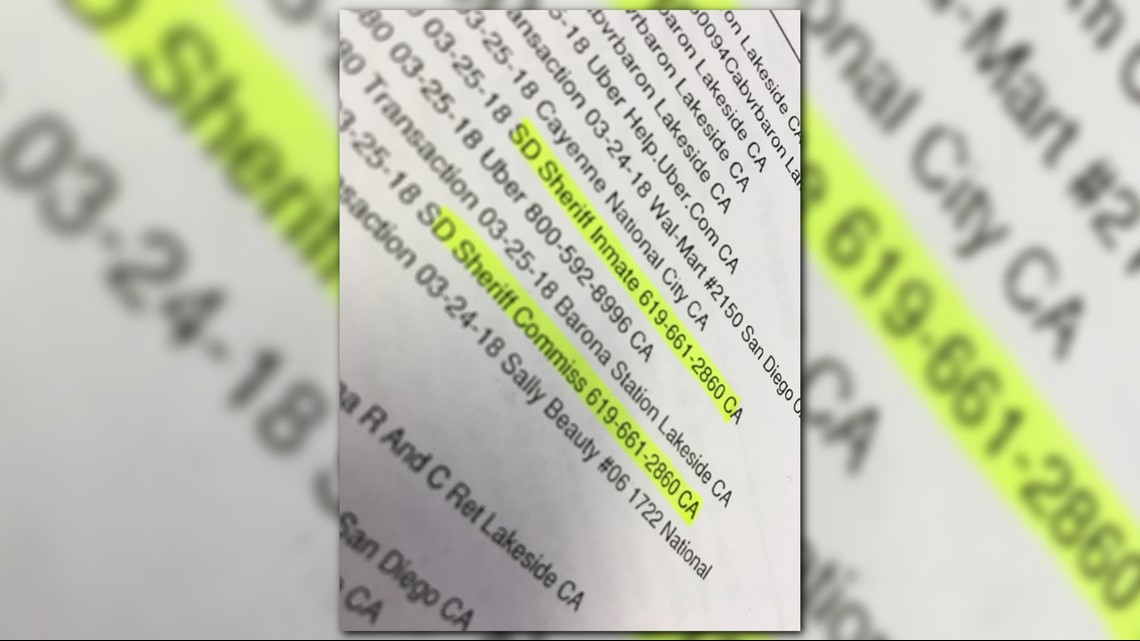

But then I received a bank statement from the Navy Federal Credit Union. My thief had fraudulently opened an account with one of the money orders and a cash advance on a shiny new credit card. The kicker, they turned around and deposited some of that money into the accounts of inmates in the San Diego jail. I hope they enjoyed the snack food and phone calls.

The worst news, however, came in a phone call. Hertz wanted to know why I had not returned the Hyundai I had rented. My ID had just been used to steal a car.

As I told the Hertz agent that it wasn’t me, I realized, she had called me directly. My thieves knew my phone number. I started thinking about how much they knew about me: my address, my bank account information, social security number, date of birth, my credit cards and even my Georgia driver’s license number.

Yet I knew nothing about them.

I tried to get a new driver’s license. The DDS website says you need to bring a police report, so I made a copy along with documentation from Hertz. It wasn’t enough, because the police report didn’t list my license number as one of the items stolen.

I contacted the Cobb County Sheriff detective assigned to my case. I explained in an email and phone call what I needed and why. In more than a month, he has yet to respond to either and I am still stuck using the same ID.

Since the detective didn’t care about helping me clear my name, let alone the evidence that could help investigate the case I began to feel nothing would ever be done. Thankfully, I was wrong.

About a month after the ordeal began, my husband received a phone call from a detective in San Diego. Police had arrested a man named Barron McNulty for a series of burglaries. In his wallet was a fake Georgia driver’s license with my husband’s information, but McNulty’s picture. The detective wanted to warn my husband he may have been a victim of ID theft.

Clearly, we already knew and my husband quickly directed the detective to me, since most of our problems had occurred in my name, using my information.

It didn’t take long for police to develop a suspect, who was already wanted for other crimes.

Of course the big question is always, how did the thieves get the information? Even with a suspect, it seems police rarely know for sure. Given the level of detail thieves managed to obtain in my case, they say it had to of come from a data breach, likely with a credit reporting agency like Equifax. The data is sold to people like McNulty, who then pay to get fake ID cards so they can begin to work the system.

Police believe the woman pretending to be me, is actually the one who makes those ID cards. To her credit, investigators say she’s really good. They also say Georgia has been a popular target lately.

While I’m thrilled police have a suspect, I’m disheartened that few law enforcement departments either have the interest or resources to investigate these kinds of crimes directly. Our suspects were committing other offenses, and just happened to be caught stealing identities, too.

So I will end with perhaps what I should have started with, the lessons learned. I’m not expert and these merely represent my opinion after going through this:

► Take a deep breath, you will get through this. It took more than a month to get a true hold on what had happened. We had to open a new bank account (and chose to go with a different bank) which took time to establish. You have to get new checks printed, pull money from other accounts to get it started, wait for a debit card to show up in the mail so you can actually use an ATM. You have to set up your direct deposits all over again and switch out the info on your auto pay bills. With every fraudulent account, you have to call to close it and alert the credit agencies. It will take time. It will get done.

► Keep a savings account with a different financial institution. This was our saving grace. When our checking account was compromised, we were able to pay our mortgage with this account. Our account is with an online bank, so we were limited in how we could access the funds. But if you get an account with a brick and mortar facility, you could also go in to get cash.

► Freeze your credit now. My husband was part of this scheme, but much less so, because his credit was already frozen.

► Put passwords to your accounts with credit agencies in a safe place. When my husband needed to lift his freeze so we could open new accounts, like our bank account, he couldn’t find his passwords. He had to lift his freeze by snail mail. Without a checking account, he had nowhere to cash his checks and we had to apply after the fact to have him added to the new bank account.

► More importantly - realize a credit freeze won’t protect your existing accounts. A credit freeze does NOTHING to stop someone from making a purchase off of a credit card you already own, or draining money from your bank account. I’ve now set up alerts on all of my accounts. If someone makes a purchase over a certain limit or withdraws money, I’ll know right away. It won’t stop it from happening, but it will allow me to react sooner.

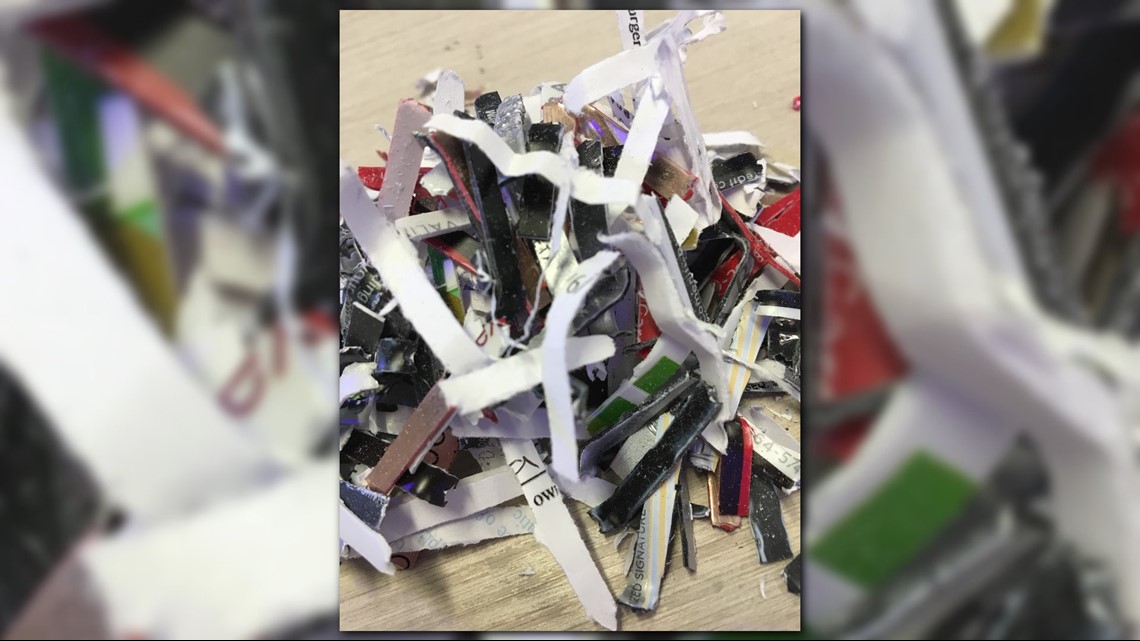

► Keep all of your documents. The first few days, I shredded letters after I had closed the accounts. But as the case grew, I started saving them, not knowing when it all would end. I never imagined police would have a suspect in my case, but now that they do, my documents have become evidence and will likely lead to additional charges when she’s arrested.

WATCH REBECCA LINDSTROM'S FULL REPORT, SUNDAY NIGHT ON THE LATE FEED.