In order to take advantage of Georgia's film tax credits, most production companies transfer or sell them to other taxpayers.

The booming film industry has created a bustling financial market.

"A tax credit is really like a voucher," said Ryan Millsap, who is the founder of Blackhall Studios. "We're attracting the best kind of filmmakers - the kind of filmmakers who are funded, who know they're going to finish and get rewarded."

The rewards are the tax credits.

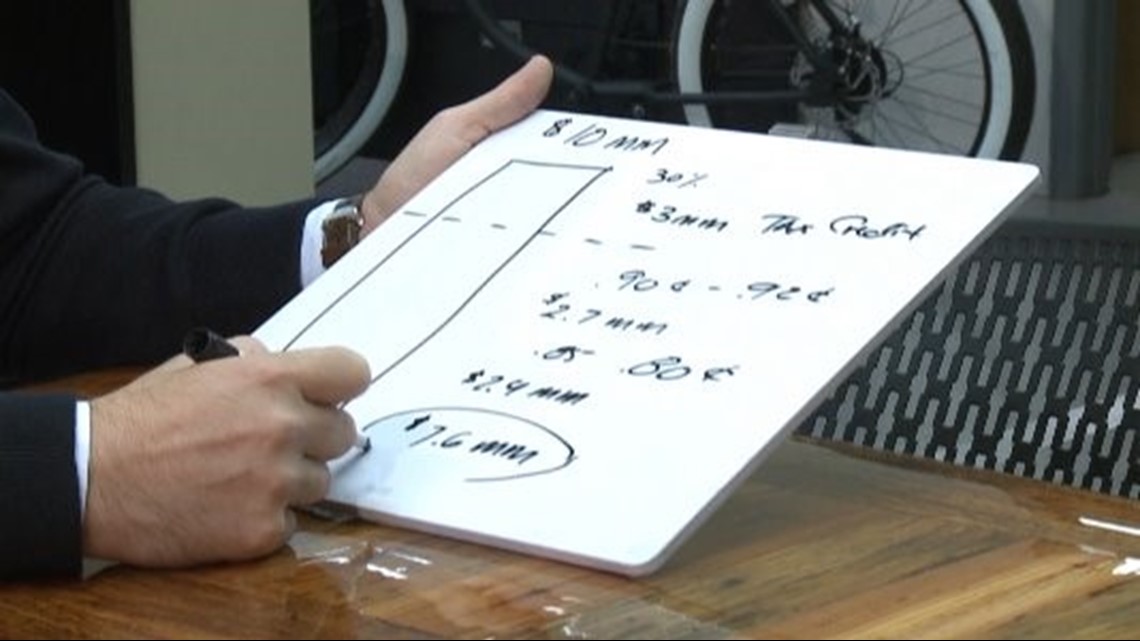

"If you make a movie, and the whole movie costs me $10 million, the state of Georgia will give you a credit up to 30 percent." Millsap added. "That works out to $3 million."

The Georgia Department of Economic Development provides 20% of production expenditures in transferable tax credits for feature films, television series, commercials, music videos, animation and game development.

Productions can earn another 10 percent by including an embedded Georgia logo on approved projects and a link to ExploreGeorgia.org/Film on the promotional website.

Productions must spend a minimum of $500,000 to qualify, and the expenditures must be made in Georgia using a Georgia vendor.

What happens next is where things get interesting.

"So now, if I'm a production company that's just been issued $3 million in tax credits, I don't have use for all those tax credits," Millsap explained. "In fact, what I really want is to make the cost of my movie be less. So I take those $3 million in tax credits and I go to the market."

Yes, there's a market for film tax credits.

Anyone in Georgia with larger tax liabilities - individuals or businesses - can go to the market to buy credits to pay their taxes.

"That marketplace is very robust," Millsap said. "And the tax credits aren't tied to a particular year. Once you buy them, you could hold them and use them next year, or you could apply them to taxes you owed for the year before."

"These generally trade for 90 cents," he added. "So instead of $3 million, I might be able to get $2.7 million."

But most transactions involve a broker, who takes a cut, so the credits sell for less.

"Let's make the math easy and say they sell for 80 cents on the dollar. Now I get $2.4 million," Millsap continued. "So I just subtract that from my $10 million I just spent to make the movie, and I ended up only spending $7.6 million. I made a $10 million movie for $7.6 million."

Millsap described Georgia's film tax credit program as clean and easy with no wait, like in New York, where it can take years to cash in.

He sees a clear payoff for Georgia's economy.

"There's 49 other states that would die to have this program and this level of success with this tax credit," he added.

Georgia lawmakers had a vision when they set up this program in 2005 and amended it in 2008.

They knew they would forgo tax dollars they might otherwise collect by offering film credits, but they could see that the industry had enormous potential to grow and boost the economy.

According to the Georgia Department of Economic Development, nearly 29,000 people are directly employed by the motion picture and television industry in our state.

Since 2010, 16 film and TV studio facilities have relocated or expanded in Georgia.

During the 2017 fiscal year, production companies spent $2.7 billion on 320 feature films and tv projects.