DENVER — It usually begins with a very threatening automated phone call: a warning that you'll be arrested if you don't fork over a sizable piece of cash you allegedly owe for not paying taxes.

The IRS phone scam is back in the Denver metro area, and it's growing.

The number of these phone calls continues to increase because the ploy continues to work. Since October 2013, over 10,000 victims have lost over $54 million to the scam, according to a report from the Treasury Inspector General for Tax Administration.

To give you a better idea of how these scams work, and to help prepare you to defend against them, we decided to engage one of the scammers and follow their ploy.

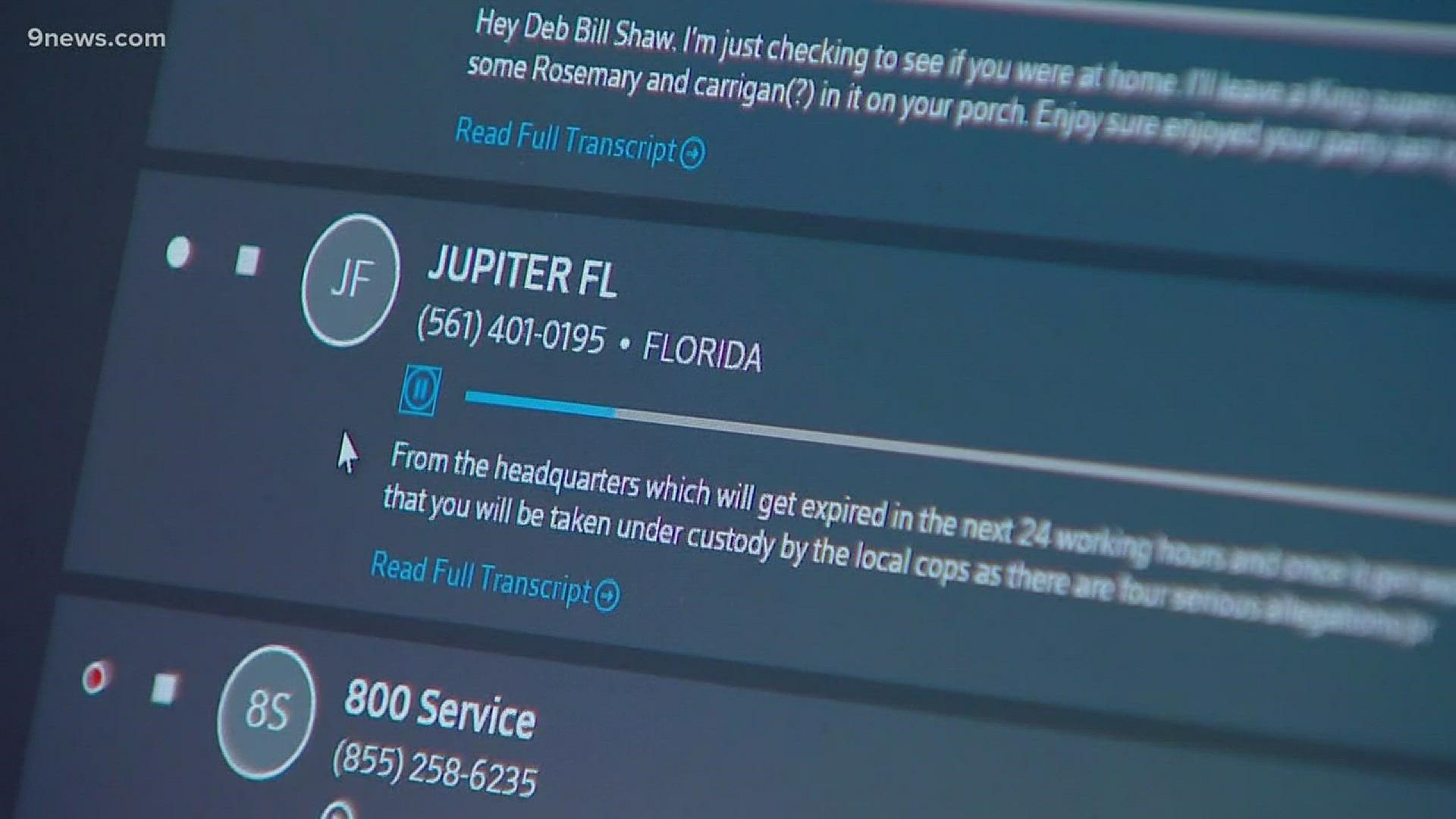

Debra Wells, the community relations manager at the Alzheimer's Association of Colorado, got the call. She described it as a very mechanical sounding voice, using poor grammar and threatening her with immediate arrest.

The caller told Wells: "You will be taken into custody by the local cops, as there are four serious allegations pressed on one name at this moment."

Fortunately, Wells knew she was talking to a scammer. But tens-of-thousands of others take the bait.

The thieves are all off-shore, using a sophisticated robocall software that can mimic the first six digits of your phone number. They will answer calls posing as IRS agents.

When I re-dialed the number that had called Wells, the voice that answered said: "Thank you for calling the Internal Revenue Service. How may I help you?"

I replied to the so-called agent, telling him I had been instructed to call the number because I'd been told I was having a problem with my IRS account.

Most of the fake agents, including this one, have heavy accents, and all are following the same script.

"May I have your first name and last name sir?" the fake agent asked.

Once you give your name, they will tell you that you are facing arrest and that a warrant has been issued.

"There is a warrant issued against your name, Mr. Koebrich, regarding your federal tax fraud," the thief told me.

They will ask you to write down a phony arrest warrant number.

"Write down your arrest warrant ID number. The number is 00-100," the fake agent said.

They will also give you a bogus case number; another attempt to make the scam appear more authentic.

"Your case name is 806942," the thief told me.

The scammer identified himself as Rick Jones and told me his badge number was RJ31247939.

He even provided me with another phone number to use if I'd like to call and verify his identity. Of course, that number simply rings to another thief in the same call center who will also insist the fake agent is real and that you are in imminent danger of being arrested.

At that point, you are again reminded a U.S. Marshall is on his way, that he will take you into custody, and that you will stand trial.

Then comes the real stunner. You are given the amount you allegedly owe the government.

"Your pending number is $4,950," the thief told me. I tried to convince him I was alarmed and that this must all be an honest mistake.

That's when the fake agent will send you to a so-called "supervisor," who will direct you to the nearest local grocery to purchase cash cards from the gift card kiosk.

They say they will take any card, any denomination that adds up to the figure you were given. You are told to never hang up, to speak with no one, and to hurry, because the Marshall's are right behind you.

After you've purchased the cards, the thieves ask for the PIN numbers on the back, so they can cash them immediately.

I gave them phony numbers, and they spotted that tactic immediately, saying they knew the numbers were not real. I told the scammer: "Well, you're correct, they're not real numbers. And you're not a real IRS agent."

Seconds later, the call was over and the thieves had hung up, moving on to the next victim.

The good news is that arrests are finally being made in both the US and India.

Many of the off-shore call centers employ thieves in the US, who launder or liquidate the extorted funds as quickly as possible to avoid detection. Once some of these scammers were in custody, US authorities were able to trace the transactions back to the call centers in India and shut down the entire operation.

It's a start. But the real key to ending the scams is to better educate American consumers to recognize when they are being extorted by off-shore criminals.

5 TIPS TO HELP YOU RECOGNIZE A SCAM

The IRS wants to remind people that it is fairly easy to detect when a supposed IRS caller is a fake.

Here are five things the scammers often do but the IRS will not do. Any one of these five things is a tell-tale sign of a scam. The IRS says they will never:

- Call to demand immediate payment, nor will the department call about taxes owed without first having mailed you a bill.

- Demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

- Require you to use a specific payment method for your taxes, such as a prepaid debit card.

- Ask for credit or debit card numbers over the phone.

- Threaten to bring in local police or other law enforcement groups to have you arrested for not paying.

If you get a phone call from someone claiming to be from the IRS and asking for money, here’s what you should do:

- If you know you owe taxes or think you might owe, call the IRS at 1.800.829.1040. The IRS workers can help you with a payment issue.

- If you know you don’t owe taxes or have no reason to believe that you do, report the incident to the Treasury Inspector General for Tax Administration (TIGTA) at 1.800.366.4484 or at www.tigta.gov.

- You can file a complaint using the FTC Complaint Assistant; choose “Other” and then “Impostor Scams.” If the complaint involves someone impersonating the IRS, include the words “IRS Telephone Scam” in the notes.

It's also good to remember the IRS does not use unsolicited email, text messages or any social media to discuss your personal tax issue. For more information on reporting tax scams, go to irs.gov and type “scam” in the search box.

SUGGESTED VIDEOS | Local stories from 9NEWS