ATLANTA — One of the most familiar names in Atlanta business – SunTrust Bank – will soon change. The company announced Thursday it was merging with BB&T to form the sixth-largest bank entity in the United States.

The new bank, which has yet to be named, will be in Charlotte, North Carolina. According to a release, the new bank will have a split board of directors – half from SunTrust, half from BB&T. If approved, the deal is expected to impact about 10 million households across the U.S.

So, what does this mean for bank accounts and jobs in Atlanta?

Emory Business School finance lecturer Kevin Crowley said that, for customers, things should be business as usual – but with the opportunity for more services in the future.

“It’s been nearly 10 years since we’ve seen anything of this scale,” Crowley said. “I think that one thing the bank is going to be very precise about is, making sure they manage this in a way that the customers stay with them and are happy. The last thing they want is customers going to Wells Fargo or J.P. Morgan.”

SunTrust is a large employer in Atlanta, leaving many to wonder if their jobs are at risk. Crowley said that jobs in departments that don’t overlap with BB&T should be safe – as well as those working in digital and online banking. However, he does believe that in the future, some branches could close.

“That is after all why companies do merge, is to get some synergy effect out of it,” Crowley said. “So, it is quite likely that there could be some branch closures but that would be to the net benefit of those two organizations.”

When it comes to competition, cutting costs and keeping interest earnings high will keep the proposed new bank afloat – and even after the merger, it would still be smaller than many other national banking institutions.

“The top four or five banks have roughly $2 trillion in assets. When (SunTrust and BB&T) come together, I think they will have $400 billion,” Crowley said. “So, they’re still going to be a big distance away from the top four elite. But, none the less, they will be in better shape to compete and provide customer service if they would have stayed outside the ranks of the top 10.”

11Alive asked SunTrust about the chance of local bank layoffs or closures. A SunTrust spokesperson said that the company plans to maintain a strong presence in Atlanta and surrounding areas, including local branches. So, for now, it appears to be business as usual.

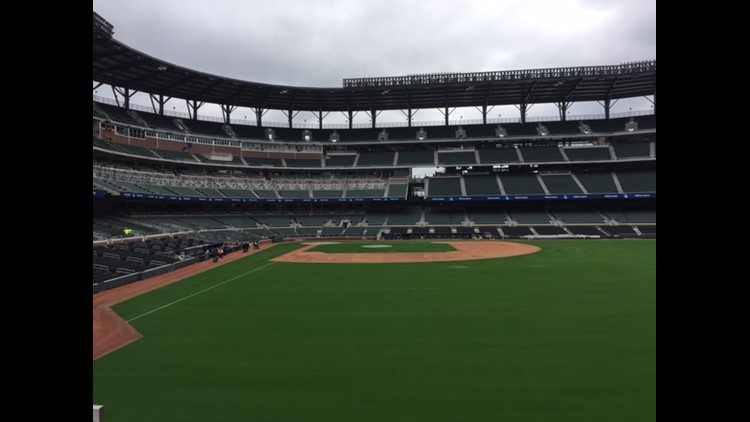

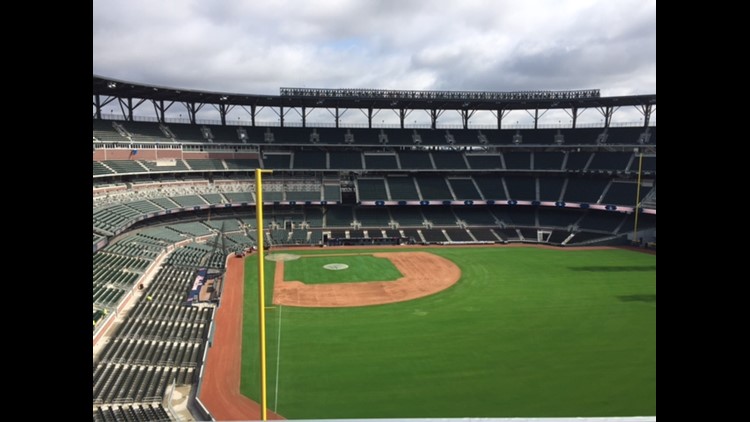

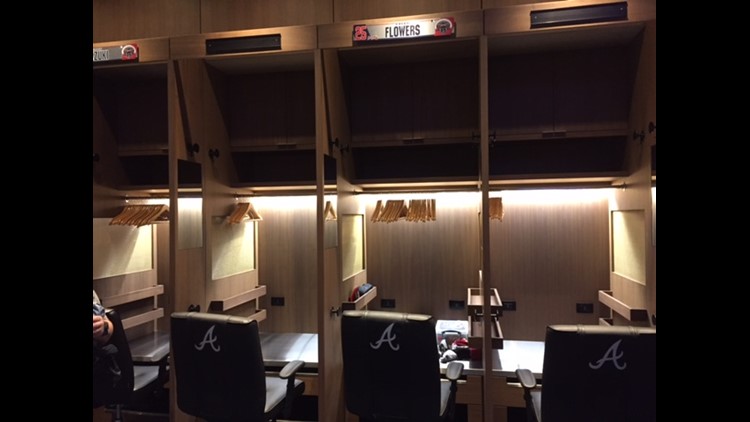

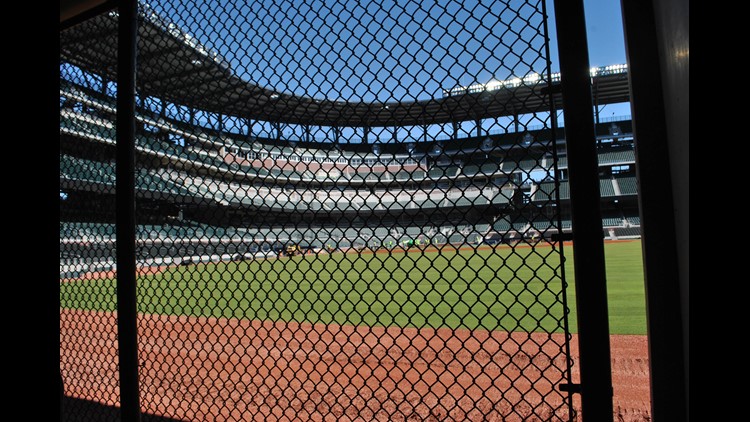

And what about SunTrust Park in Cobb County?

The spokesperson said the merger does not change the company’s commitment to the home of the Atlanta Braves.

"This does not change our commitment to SunTrust Park. In a reflection of the equal contribution both banks bring to the new institutions, the companies will operate under a new name, which will be determined prior to closing. However, for now, it remains business as usual," the PR rep said.