ATLANTA — Prepare to pay a bit more when you buy eBooks, digital music and games online.

Tuesday, Georgia’s governor signed a bill into law to tax digital downloads.

You’ll have to pay state and local sales taxes on anything you buy and download to keep, beginning in January.

And that’s expected to bring in hundreds of millions of dollars of extra revenue for the state in just the first few years.

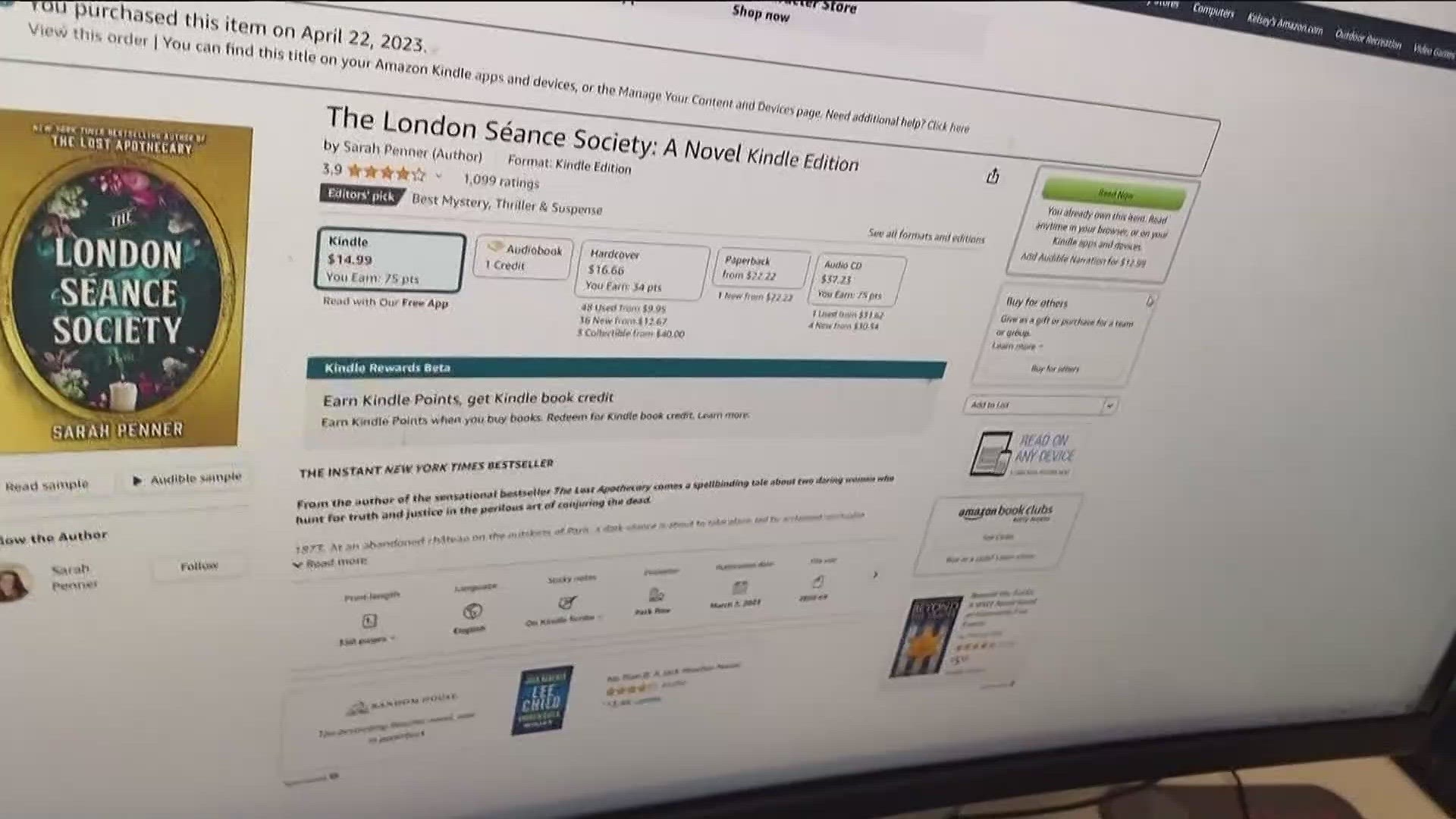

As it is, book buyers in Georgia, for example, know that when they buy the digital version of a book and download it, right now they don’t have to pay any sales taxes on it.

But customers who buy printed books, either in person or online, know that they have to pay state and local sales taxes.

Starting in January in Georgia, whatever people buy and download — such as eBooks, music, knitting patterns, video games, you name it — will have Georgia state and local sales taxes added to the purchase price.

That video game someone buys for $60 or $70 will cost four or five dollars more, depending on the sales taxes in the city and county where they live in Georgia.

Someone who spends, say, $100 on eBooks will have to pay an extra six or seven dollars, or more.

“It’s fair that they tax online books, too,” on what people download, said Kimberly McNamara Tuesday.

McNamara owns Read It Again Book Store in Suwanee. She just celebrated 20 years in business.

The business is thriving, even as more Americans than ever are buying and reading eBooks instead of printed books.

And McNamara said that having eBook buyers pay the same sales taxes that hardcopy buyers pay is fair, but it probably won’t make much of a difference to her sales, or to the digital download sales, because the two types of booksellers appeal to totally different customer bases.

“We don’t try to compete with prices online,” she said, “because we would have been out of business in ’07 when eBooks really started. So what we try to provide is a community space for people to come and read and talk to people who like to read.”

In whatever way the new state tax impacts digital download sales, it’s expected to raise a lot of money for Georgia — a projected $172 million in extra sales tax revenue in just the first full year it will be in effect.

The new digital download sales tax will not apply to everything people download.

It will not apply, for example, to online subscriptions; so newspapers that people download as part of their subscriptions will still be tax free.

But the author of the new law tells 11Alive that next year he will work to tax online subscriptions, as well, as part of the state’s long-range plan of taxing in-person and online sales the same.