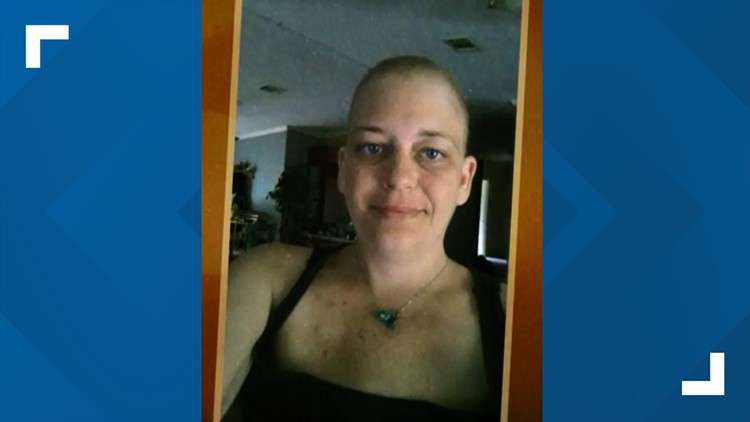

ATLANTA — Seven years ago, a routine mammogram turned Melissa Taylor's life upside down.

"Our whole life got destroyed because I got cancer at 36," she said. "We didn't do anything. We were a normal family. We paid our taxes every year. We worked. We did everything like everybody else. And lived our lives. And had two kids."

Three months after her breast cancer diagnosis, Taylor's family was nearly $60,000 in debt.

"I had insurance and we were already starting to get in debt because I had all of these copays and MRIs I have to pay. So, we were blowing through our savings," she recalled.

Employer healthcare coverage often only covers a fraction of costs.

"It used to be that when you bought insurance, your pharmacy plan and your insurance plan came from the same company, same policy, so they communicated to each other," Diabetes Advocate Della "Trip" Stoner said. "Now, they don't communicate to each other."

"What happens is they'll hand off that prescription to someone on their staff, and then that staff will try to work with an insurance company, and it can take weeks," said Stephen West, of Shields Health Solutions.

Around 2016, there was a shift in how medications are prescribed and covered. National MS Society Executive Vice President Bari Talente explained that the shift from a flat co-pay model for prescription drugs -- which was a set amount paid, usually $10, $25, $50 -- to a co-insurance model -- where patients pay a percentage of the cost of the medications, anywhere from $500 to well over $1,000 per month -- raised rates significantly.

And when patients can't afford to pay, they face deadly decisions. Taylor said it was a choice she was faced with when she went to have a bilateral mastectomy in the hospital.

"(They) refused me to go have my surgery unless I paid them $500. I didn't have $500 at that point," she recounted. "I even said, 'I'll make payments. I'll do a payment plan. I'll do anything,'" Taylor said. "I said, 'I have to have the surgery. I got cancer, I'm dying. If I don't have this surgery. I'm dead.' They didn't care."

Finding the money for the surgery was just the beginning.

"Once I started chemo, which wasn't too bad, but still now we're starting to get behind on our mortgage," Taylor said. "We knew we couldn't have the house anymore."

The family sold their dream home to pay for treatments.

"It just got so stressful, we ended up divorcing over the whole thing. And then as soon as we got divorced, she turned trans. But we ended up getting back together again, as we can't -- we figured -- we can't live without each other," Taylor explained.

Photos | Melissa Taylor

Taylor also couldn't survive without her wife's medical benefits. Coverage still comes with a cost.

"We struggle. We still have insurance. We pay," she said. "But we can't get ahead, we can't get out of the debt, we're all in."