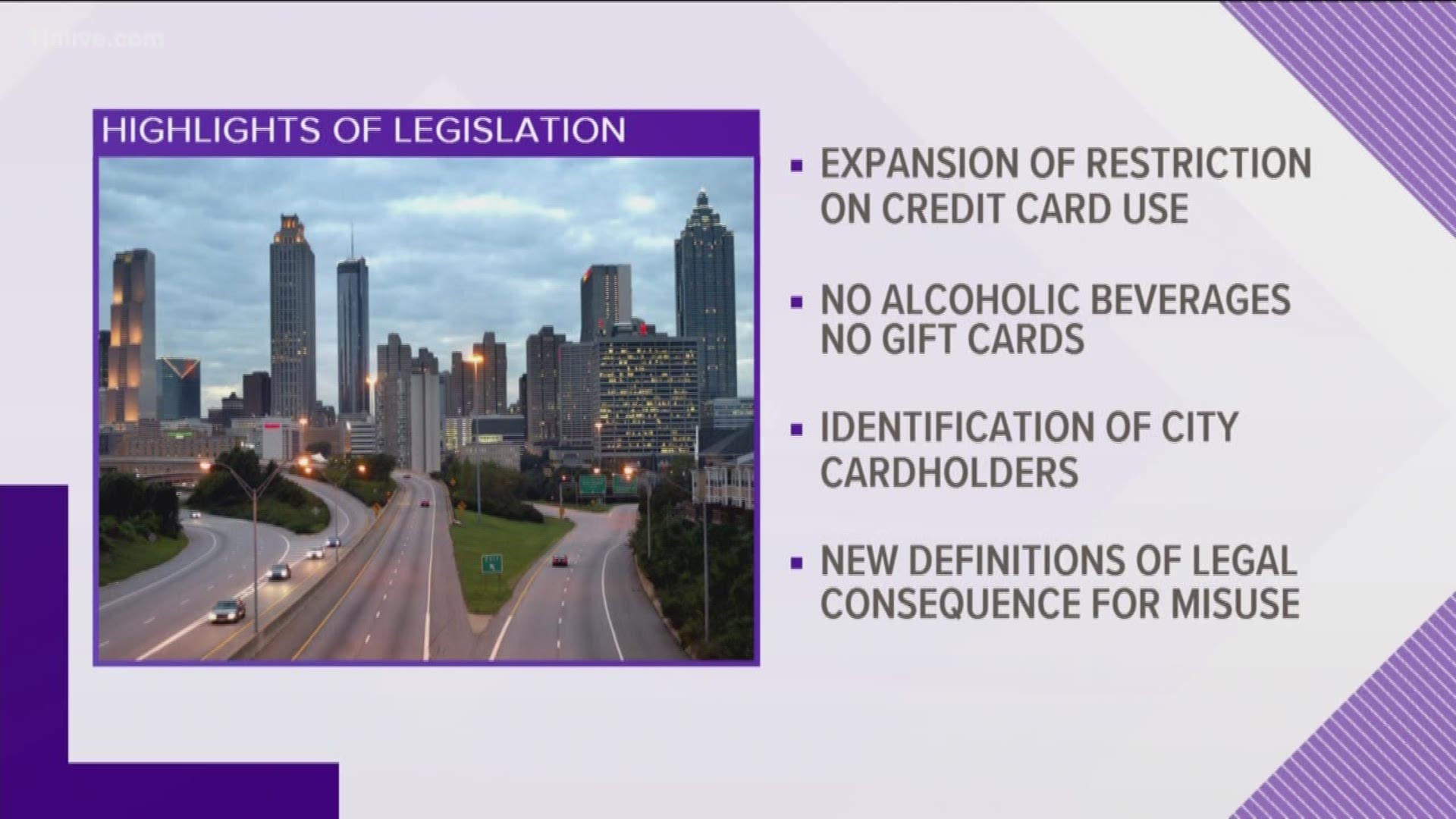

ATLANTA — The Atlanta City Council has unanimously approved new guidelines for the use of city-issued credit cards which prohibit their use in numerous cases.

The move comes less than a year after the U.S. Department of Justice subpoenaed various city card records as part of an ongoing federal investigation into former Mayor Kasim Reed's office.

However, in a statement on Tuesday, Atlanta officials said the move has more to do with accountability now than what happened years earlier.

“This credit card legislation is another important step towards a more accountable and transparent government,” Councilmember Andre Dickens said.

Dickens and councilmember J.P. Matzigkeit co-sponsored the bill as a means of putting the guidelines into city code and bringing more transparency to the use of taxpayer money. Violations of the new rules could lead to felony criminal prosecution.

Uses not allowed under the new ordinance include:

- Goods or services not directly related to official city business.

- Data plans, software, or applications for non-city issued devices including but not limited to smartphones, laptop computers, and tablets. However, data plans purchased by the authorized cardholder when traveling on official city business are a permissible use of the business credit card.

- Memberships at wholesale warehouses and shopping clubs such as Sam's Club, Costco or Amazon Prime.

- Cash advances.

- Gift cards, store value cards, calling cards and similar products.

- Personal dry-cleaning charges.

- Entertainment such as in-room movies for city employees traveling on business.

- Alcoholic beverages or products.

- Tobacco products.

- Fuel, mechanical repairs, and/or maintenance for personally-owned vehicles.

- Airline tickets for family and friends.

- Any personal use.

- Use of the business credit card by anyone other than the authorized cardholder or the authorized cardholder's designated personnel as approved by the chief financial officer.