ATLANTA — The Georgia House on Thursday approved money for a $1 billion property tax break and $1 billion income tax break as part of a plan to amend this year's budget to spend another $2.4 billion in projected revenue.

The Republican-controlled House voted 170-1 on Thursday to approve House Bill 18, sending it to the Senate for more debate.

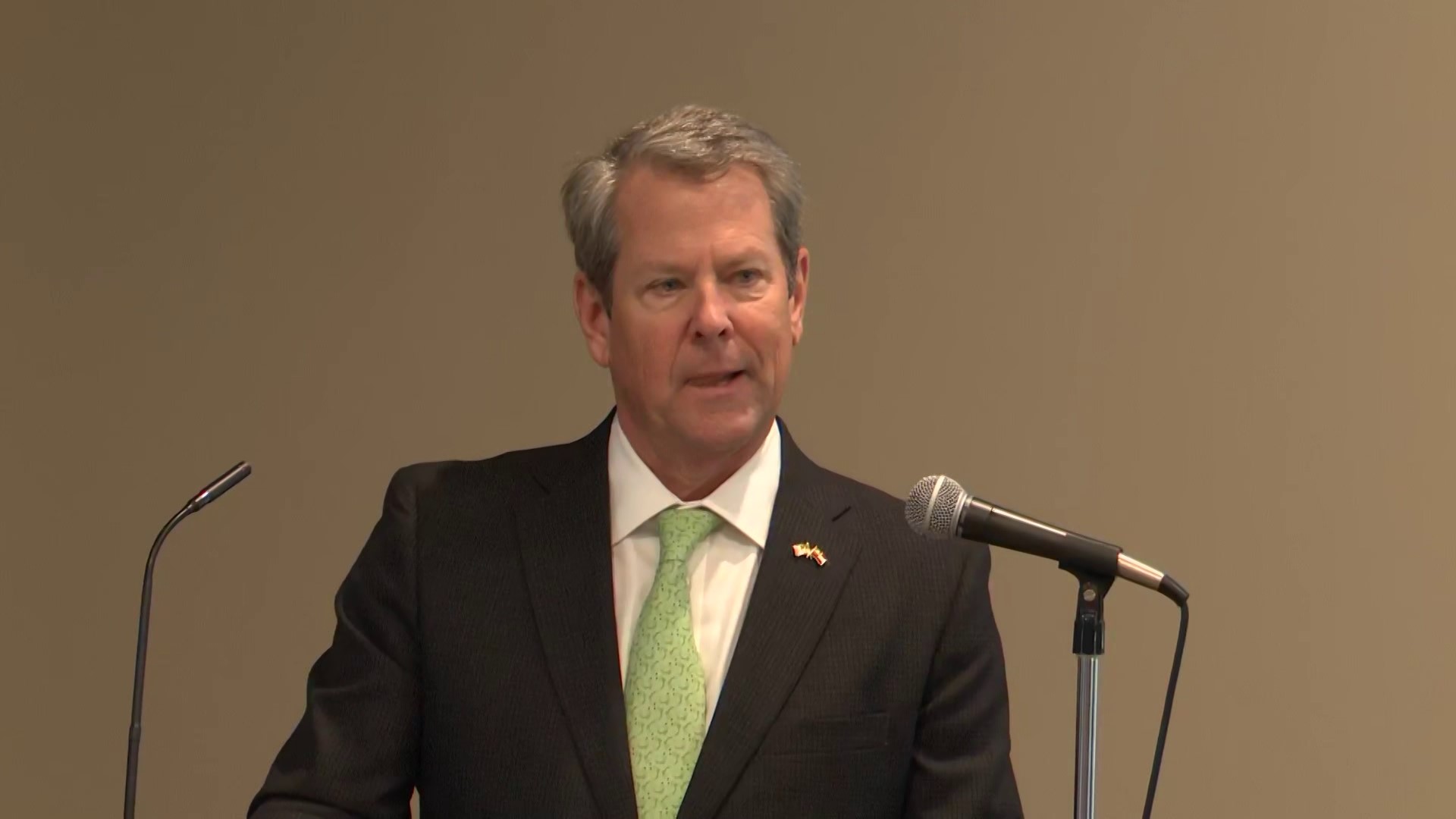

Gov. Brian Kemp now calls for spending $32.6 billion in state tax money in the budget ending June 30, up 7.3% from what the Republican originally projected last year. Including federal and other money, total spending would rise to $61.6 billion.

The House spending plan also would shift $100 million into employee health insurance to ease a steep health insurance premium increase for public school districts. It would spend $14.5 million to give one-time $250 bonus payments to 55,000 retired state employees.

“With the additional funds that are being recognized in this budget, the House joins the governor in the wise use of tax dollars with one-time needed investments in technology and capital projects, safety and security projects, economic development projects as well as human capital investment," said House Appropriations Committee Chairman Matt Hatchett, a Dublin Republican.

Most additional money would fund a second $1 billion round of state income tax rebates, which would give taxpayers between $250 and $500 back. It would also pay for the property tax rebates, which Kemp says would give the typical homeowner about $500. Both breaks need separate legislative approval.

School districts have to pay health insurance premiums for employees who don't hold teaching certificates, such as custodians, bus drivers, classroom aides and cafeteria workers. The State Health Benefit Plan had planned to increase premiums by 67% in January 2024, raising the amount charged per employee per month from $945 to $1,580, a total increase projected at $457 million a year. The House plan would now stretch that increase out over three years. The state will spend $846 million a year to cover the increase for certified employees including teachers. The premiums that employees directly pay wouldn’t change.

House members rejected Kemp’s plan to provide $25 million in grants to school systems to help children make up for missed learning, instead adding that money to what Kemp already proposes spending on school security grants. Shifting that and some other cash into security grants would provide $60,000 per school.

The budget also shifts $1.1 billion from the state's $6.6 billion in surplus cash to the state Department of Transportation. That money will replenish road-building accounts after the state suspended gasoline and diesel taxes for 10 months.