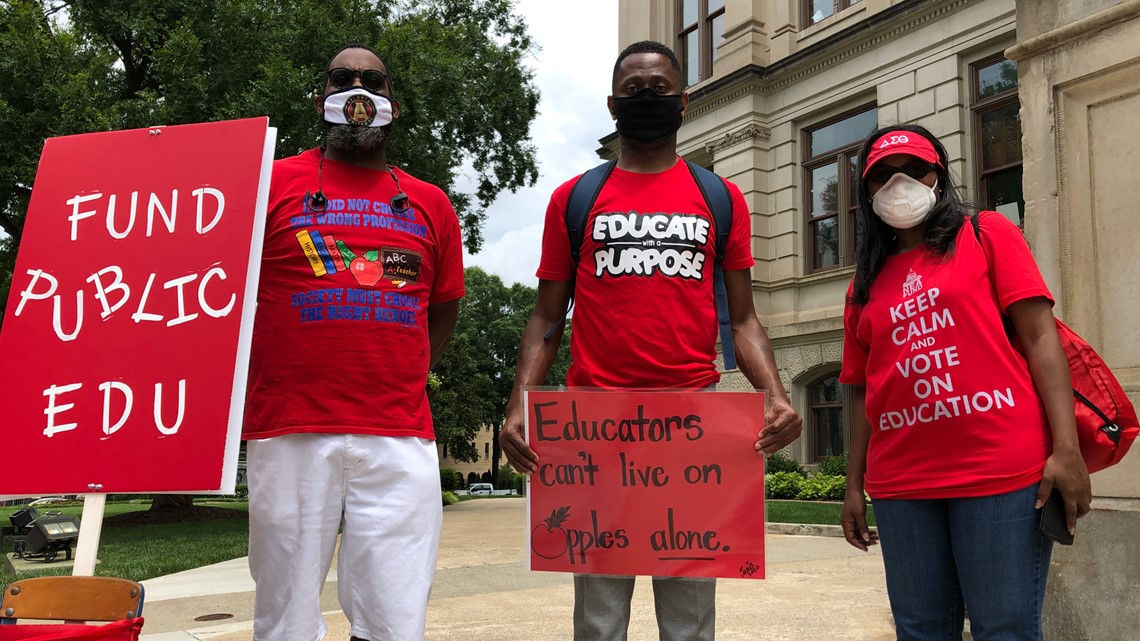

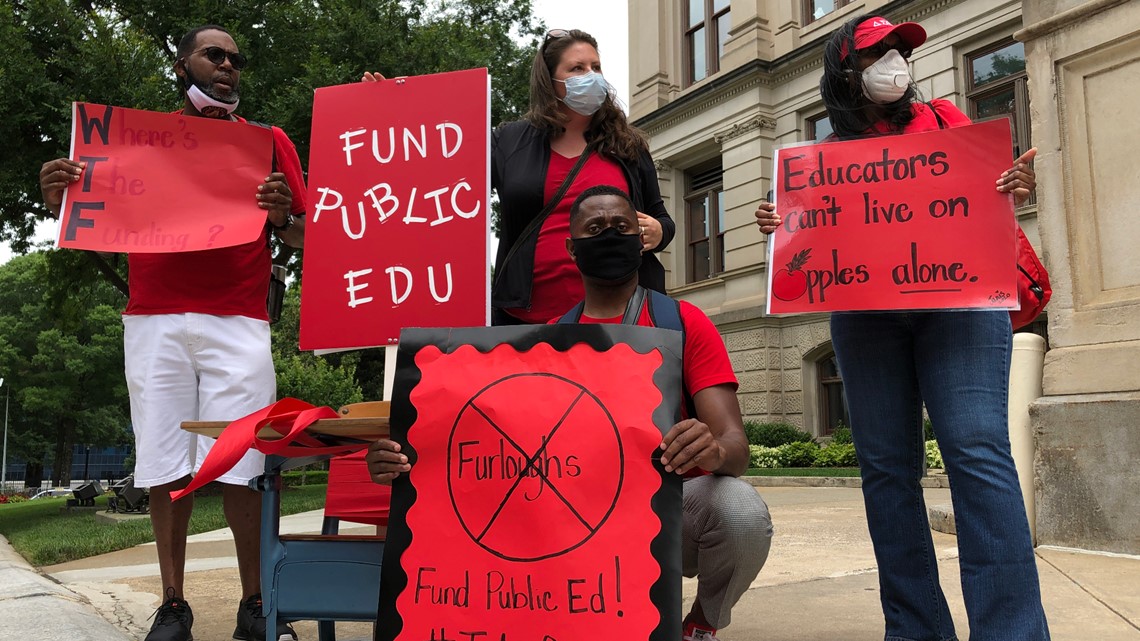

ATLANTA — This week, teachers and educators gathered on the steps of the Capitol building in downtown Atlanta from as far away as Catoosa County in reaction to severe budgets planned for the Georgia Department of Education (GaDOE) for the upcoming school year and beyond.

Instructors and educators have been meeting ad hoc over the course of the past two weeks to advocate on behalf of their students to Governor Kemp and other Georgia lawmakers for the futures of their students.

“In this time of unprecedented crisis, we beseech you, our state leaders, to do everything within your power to minimize the damage to Georgia’s public education system as a result of pandemic-based budgetary cuts,” said the Rev. Diane Dougherty, a retired Catholic school teacher of 46 years.

The proposed budget cuts are in direct response to the financial impact caused by the COVID-19 shutdowns.

Ultimately, while budget cuts to the GaDOE’s budget may be unavoidable, the current plan to reduce the state agency’s budget by 11 percent would have long-lasting and potentially negative results.

11 percent may not sound like a substantial amount of money but, as it stands now, that's roughly $1.2 billion of the total GaDOE budget - $1.13 billion of which goes directly to local schools.

If the cuts to GaDOE’s budget are in the long run, agencies such as the Georgia Budget and Policy Institute (GBPI) and the Georgia Coalition for Public Education stress that they are made as strategically as is possible.

Proposed options for reclaiming lost funds suggested by GBPI include:

- Raising the tobacco tax to the national average

- Trimming tax expenditures and loopholes,

- Eliminating the state’s double deduction.

- Request additional federal relief funds to aid in GA's response to COVID-19.

- Highlight one tax credit – the Georgia Private School Tax Credit - that annually diverts $100 million from $1.4 billion in additional revenues.

“Our leaders must recapture lost revenue given out through billions of dollars in special interest tax breaks and raise new revenues in order to reduce revenue shortfalls and ensure funding flows to health, education, programs for families experiencing poverty and more,” GBPI Senior VP Jennifer Owens said in a press release earlier in June.

The GBPI, alongside 36 other organizations, is focused on finding ways to protect and properly fund services and programs that are critical to helping Georgia recover from the economic recession caused by the COVID-19 pandemic and recession.