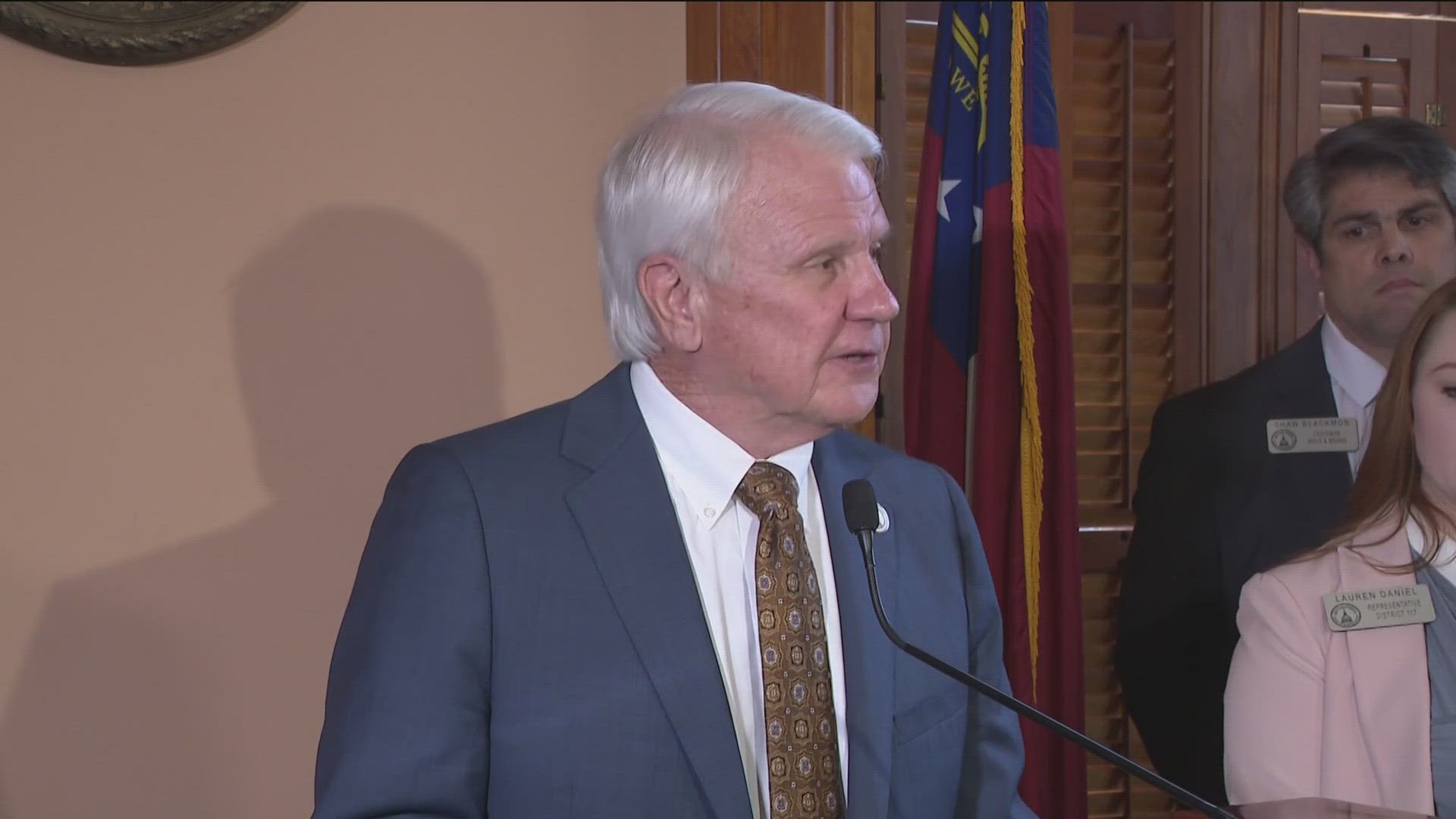

ATLANTA — Georgia House Speaker Jon Burns announced Wednesday plans to push bills aimed at several tax cuts across the Peach State, including child and homestead exemptions.

Here's a breakdown of the proposed bills:

Increase in child tax deductions

First, with the rising childcare costs, Burns said a bill has been proposed to increase the child tax deductions from $3,000 to $4,000.

"We're hoping this extra $1,000 deduction per child will help alleviate some of those costs for parents in our state," Burns said at a press conference.

Rep. Lauren Daniel, a mother of four children, is sponsoring the bill.

"I think it's a positive thing for the families of the state; we are hit with rising costs at the grocery store, rising costs in childcare... rising costs to afford our mortgages," Rep. Daniel said. "This is something that helps and hopefully will continue to help every family in the state."

Double the homestead exemption

Additionally, Burns announced a bill that would change the homestead tax exemption from $2,000 to 4,000.

Burns said this will help deliver important tax relief to Georgia homeowners as interest rates are still hovering at 7% and home prices at record highs.

"We want to lessen the financial burden for Georgians to purchase a home," he added.

Taking the cap off Revenue Shortfall Reserve

Next, Burns spoke about removing the cap on the Revenue Shortfall Reserve, which he said: "will allow our state to save to responsibility, build on reserves and provide more tax relief for Georgia families both short-term and the long-term for those times when our financial situation may not be as strong as it is today."

Acceleration in tax cut

Lastly, Burns said they will continue building on the House-led historic tax cut by accelerating the income tax by 5.75% to 5.39%

Burns estimated this will return another $1 billion to Georgia taxpayers.

"This will be on top of the $5 billion we've already given back to taxpayers over the last couple of years alone," he added. "Taken together as a whole, these bills will provide significant tax relief for taxpayers across our state."

You can re-watch the full press conference below: